san antonio local sales tax rate 2019

Did South Dakota v. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

Texans Pay 3 8 More In State Taxes Than Californians I Thought It Was A Low Tax State R Texas

Sales Tax Calculator of San Antonio for 2019.

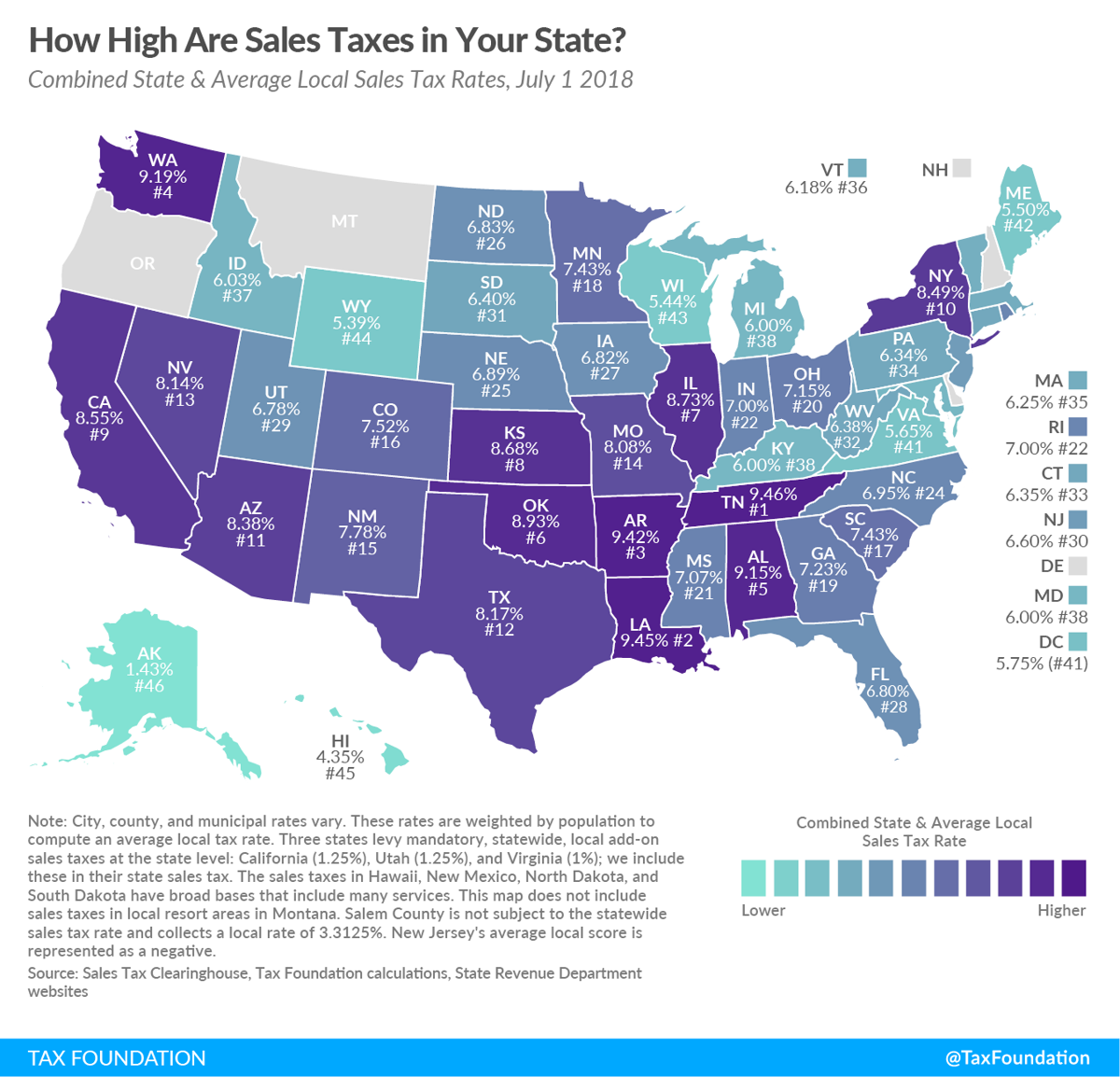

. Both Baton Rouge and New Orleans Louisiana previously had combined rates of 10 percent but these cities rates dropped slightly. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent. City sales and use tax codes and rates.

0500 San Antonio MTA Metropolitan Transit Authority. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. Rules Texas Administrative Code.

This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates. The San Antonio Texas general sales tax rate is 625.

Wayfair Inc affect Texas. The taxable value of private-party purchases of used motor vehicles may be based. Maintenance Operations MO and Debt Service.

Did South Dakota v. Both Baton Rouge and New Orleans Louisiana previously had combined rates of 10 percent but these cities rates dropped slightly. 1000 City of San Antonio.

Bexar Co Es Dis No 12. 0250 San Antonio ATD Advanced Transportation District. Wayfair Inc affect Florida.

0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. You can print a 7 sales tax table here. The County sales tax rate is.

San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2. Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent.

The Florida sales tax rate is currently. The minimum combined 2022 sales tax rate for San Antonio Florida is. For tax rates in other cities see Florida sales taxes by city and county.

San Antonio collects the maximum legal local sales tax. Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. This rate includes any state county city and local.

The San Antonio sales tax rate is. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City. Texas Comptroller of Public Accounts.

The County sales tax rate is. 625 san antonio tax 125. 05 lower than the maximum sales tax in FL.

San Antonio FL Sales Tax Rate. This is the total of state county and city sales tax rates. Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2.

4 rows San Antonio TX Sales Tax Rate. There is no applicable city tax or special tax. San Antonio has a higher sales tax than 100 of Texas other cities and counties.

The Texas sales tax rate is currently. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. Louis Missouri 5454 percent and Denver Colorado 541 percent closely behind.

The San Antonio sales tax rate is. 2019 Official Tax Rates Exemptions. Local Tax Rate a Combined Rate Combined Rank Max Local Tax Rate.

The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. There is no applicable county tax. Local Code Local Rate Total Rate.

San Antonio TX Sales Tax Rate The current total. The latest sales tax rate for San Antonio TX. Each tax year local government officials such as City Council Members School Board Members and Commissioners Court examine the taxing units needs for operating budgets and debt repayment in relation to the total taxable value of properties located in the jurisdiction.

The minimum combined 2022 sales tax rate for San Antonio Texas is. Local option sales tax. Contents Local sales taxes.

127 rows Birmingham has the highest local option sales tax rate among major cities at 6 percent with Aurora Colorado 56 percent St. The current total local sales tax rate in San Antonio TX is 8250. The current total local sales tax rate in San Antonio FL is 7000.

ICalculator US Excellent Free Online Calculators for Personal and Business use. The San Antonio Sales Tax is collected by the merchant on all qualifying sales made within San Antonio. 0125 dedicated to the City of San Antonio Ready to Work Program.

The San Antonio Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 San Antonio local sales taxesThe local sales tax consists of a 125 city sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. State and Local Sales Tax Rates as of January 1 2019 State State Tax Rate Rank Avg. The Official Tax Rate.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. 1000 City of San Antonio. Bexar Co Es Dis No 12.

The current total local sales tax rate in San Antonio. 2018 rates Zip code 78216 2019 sales tax fact 89 zip codes Special sales tax San antonio turned The latest sales tax rate for San Antonio TX.

Understanding California S Sales Tax

Understanding California S Sales Tax

Texas Sales Tax Guide For Businesses

Which Texas Mega City Has Adopted The Highest Property Tax Rate

A Texas Sales Tax Increase Would Hit Poor People The Hardest The Kinder Institute For Urban Research

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Joe Biden Tax Plans Proposals Tax Foundation

Sales Tax Rates In Major Cities Tax Data Tax Foundation

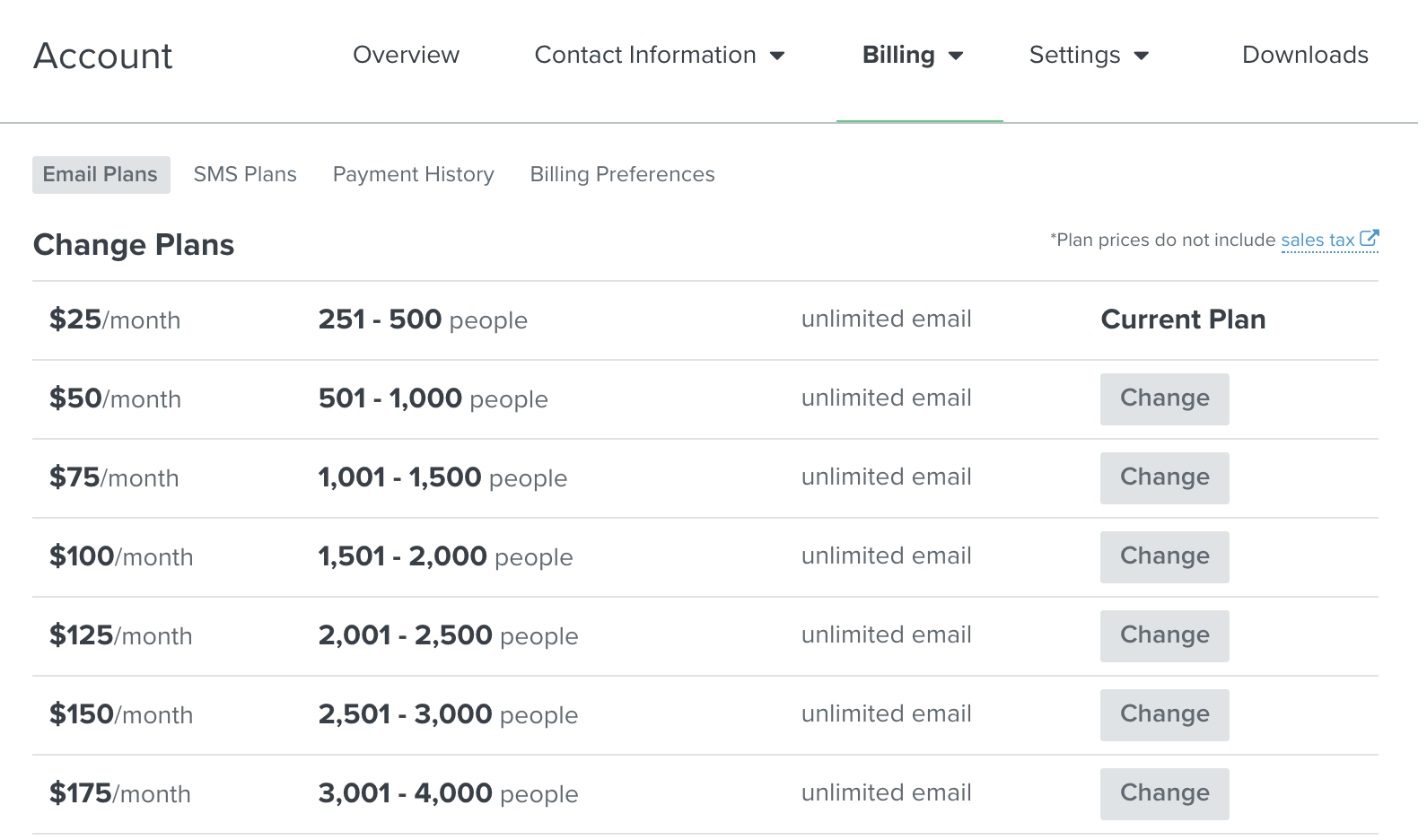

About Sales Tax In Klaviyo Klaviyo Help Center

Understanding California S Sales Tax

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Understanding California S Sales Tax

Understanding California S Sales Tax

Texas Sales Tax Guide And Calculator 2022 Taxjar

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Tennessee Now Has The Highest Sales Tax In The Country Pith In The Wind Nashvillescene Com

How To Calculate Sales Tax On Almost Anything You Buy

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org